2024-03-20

2024-03-20

Article source: Interface Author: Hou Ruining

China has surpassed Japan and once again become the world's largest importer of liquefied natural gas (LNG).

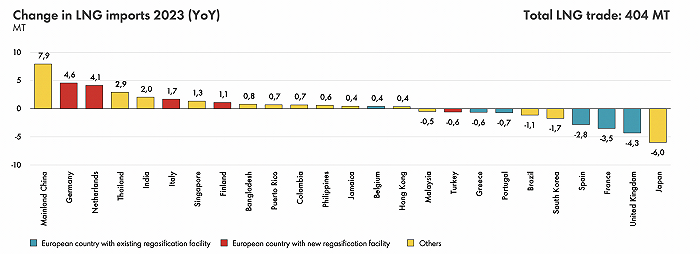

Recently, Shell Group released the "LNG Outlook Report 2024" (hereinafter referred to as the "Report"), which shows that China's LNG imports in 2023 were 72 million tons, a year-on-year increase of 7.9 million tons, making it the world's largest LNG importer.

Last year, China's natural gas market achieved restorative growth.

According to data from the National Development and Reform Commission and the General Administration of Customs of China, the apparent consumption of natural gas in China reached 394.53 billion cubic meters in 2023, a year-on-year increase of 7.6%; China's LNG import volume reached 71.32 million tons, a year-on-year increase of 12.6%.

Due to the restart of more nuclear power plants, Japan's natural gas demand decreased last year.

In January of this year, the Japan Atomic Energy Corporation Industry Forum announced that Japan's nuclear power generation in 2023 will be 81 TWh, a 50% year-on-year increase. Temporary data from the Japanese Ministry of Finance shows that Japan imported 66.15 million tons of LNG last year, a year-on-year decrease of 8%, the lowest import volume since 2009.

China and Japan are both major importers of LNG. In 2021, China surpassed Japan for the first time to become the world's largest LNG importer.

According to the report "LNG Trade in 2021: Out of Control and Recovery" released by IHS Markit, the import volume of LNG from China in 2021 was 81.4 million tons, a year-on-year increase of 18%; The import volume of LNG from Japan is 75 million tons, which is basically the same as the previous year. This is the first time since the early 1970s that China's LNG import volume has ranked first in the world.

In 2022, Japan's LNG import volume was nearly 72 million tons, although a year-on-year decrease of 3.1%, it surpassed China and returned to being the world's largest LNG importer; During the same period, China imported approximately 63.44 million tons of LNG, a year-on-year decrease of 19.5%.

Last year, the import volume of LNG from Europe remained unchanged from 2022, exceeding 120 million tons.

The above-mentioned report states that after a sharp decline in Russia's pipeline natural gas exports to Europe in 2022, LNG continued to play a crucial role in ensuring energy security in Europe last year, and the newly built regasification facilities helped improve the security of energy supply.

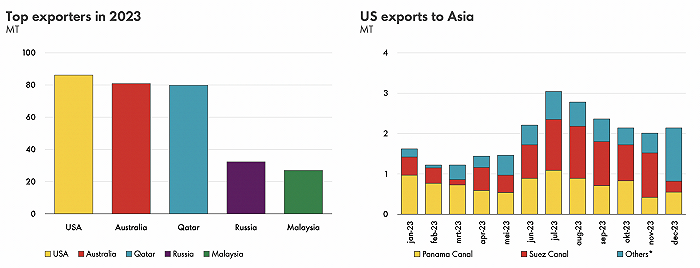

The United States has become the world's largest LNG exporter. The report shows that the United States exported 86 million tons of LNG last year, surpassing Australia and Qatar.

According to the report, the total global LNG trade reached 404 million tons in 2023, which is higher than 397 million tons in 2022, with a year-on-year increase of only about 2%.

Shell believes that tight LNG supply and price and price fluctuations above historical averages have constrained the growth of trade volume.

The report states that although the global natural gas market has sufficient supply in 2023, Russia's pipeline natural gas supply to Europe is insufficient, and last year's LNG supply growth was limited, which means that the global natural gas market is still structurally tight.

From a price perspective, compared to the historical high prices and unprecedented price fluctuations from the end of 2021 to 2022, the relatively balanced global natural gas market in 2023 will help reduce and stabilize natural gas prices in major importing regions of Europe and East Asia. However, last year's natural gas prices and volatility are still significantly higher than during the period from 2017 to 2020.

In addition, countries that rely on natural gas heating have relatively mild winter temperatures, coupled with high levels of natural gas reserves, increased nuclear power generation, and mild economic recovery in China, all of these factors will help balance the global natural gas market in 2023.

Shell stated in the aforementioned report that according to the latest industry estimates, although natural gas demand in some regions has reached its peak, global natural gas demand continues to grow, with Asian countries including China being the main driving force.

Steve Hill, Global Executive Vice President of Shell Energy, stated that China's industrial sector is seeking to reduce carbon emissions by shifting from coal to natural gas, and therefore may lead global LNG demand growth before 2030.

Shell predicts that with the acceleration of China's industrial coal to gas conversion pace and the use of more LNG by South and Southeast Asian countries to support their economic growth, global demand for LNG is expected to increase by more than 50% by 2040, reaching around 625-685 million tons per year.

After 2030, the decline in natural gas production in some countries in South and Southeast Asia will drive a surge in their demand for LNG, as these economies increasingly require large amounts of natural gas for their gas-fired power plants or industrial use. Therefore, South and Southeast Asian countries need to invest heavily in natural gas import infrastructure.

In the future, the United States will become a major growth country in the world's LNG supply. The report predicts that North American LNG production will account for approximately 30% of the global total LNG production.

Some of the articles published in this news column are sourced from the Internet. The purpose of reprinting is to convey industry news and information sharing. The articles do not mean that this column agrees with its views and is responsible for its authenticity, nor do they constitute any other suggestions. If you find any works on the website that infringe on your intellectual property rights, please contact us and we will promptly modify or delete them.